Property taxes are often perceived as a burden and, as such, represent an undesirable cost for both property buyers and sellers. However, property taxes help regulate the real estate market in Croatia. They are used to finance public works, as a tool for market stabilization, and as a mechanism that provides insight into legal transactions and property ownership.

Property taxes in Croatia can be divided into 3 significant categories:

The taxes to be paid during real estate transactions vary depending on who is responsible for paying them and when. Some taxes apply to buyers, some to sellers, and others to companies.

Taxes and costs to be paid during real estate transactions:

What are these taxes, who is responsible for paying them, and why is it important to be aware of them? Read on below.

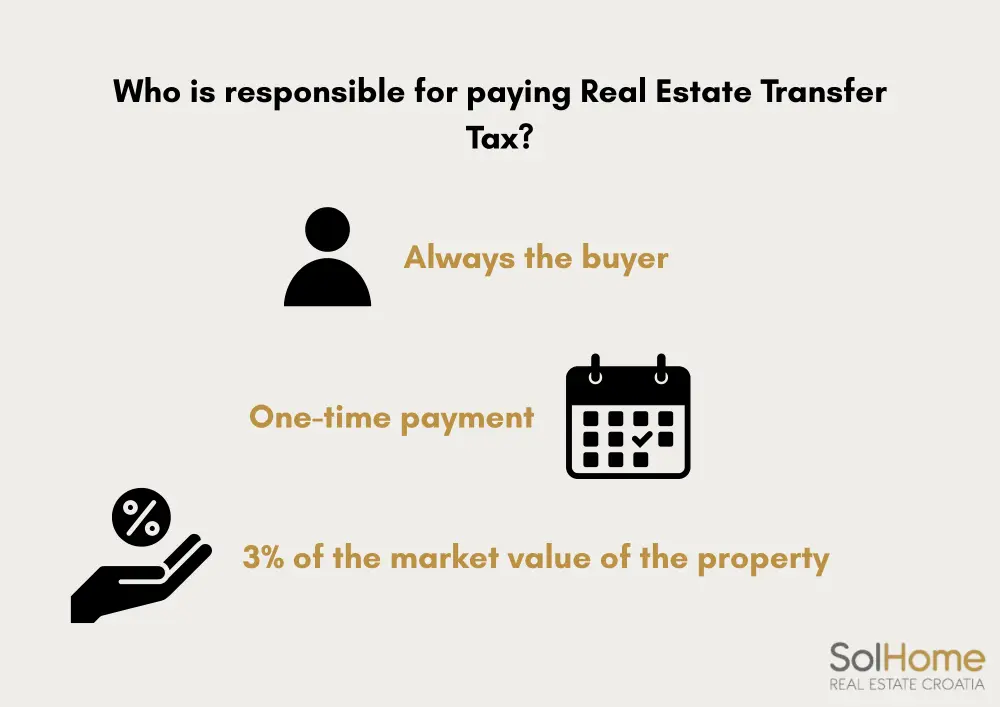

Real estate transfer tax is a tax paid during the sale and purchase of real estate, and by law, the buyer is responsible for paying it. This tax serves as a source of income for local self-government units and is used to increase market transparency and ensure the legal regulation of real estate transactions. The real estate transfer tax is perhaps the most widely recognized in the context of real estate transactions.

This is a tax that property sellers must pay if they sell a property within two years of purchasing it. What is important to understand about this tax is the tax base, the tax rate, and when and how it must be paid.

Gift tax is a tax that must be paid when a property is transferred; if it is not a sale but a gift or inheritance.

In addition to the standard tax costs when purchasing real estate, there are other costs to consider:

For accurate and up-to-date information on all additional costs, it is recommended to contact a real estate agency or check the official website of the Ministry of Economy.

Taxes on renting real estate in Croatia allow for the tracking of property ownership and transactions, contributing to market transparency and preventing the avoidance of obligations to the state.

If you decide to rent out your property in Croatia, review the common taxes:

Who is responsible for paying these taxes and why is it important to be aware of them? Read on below.

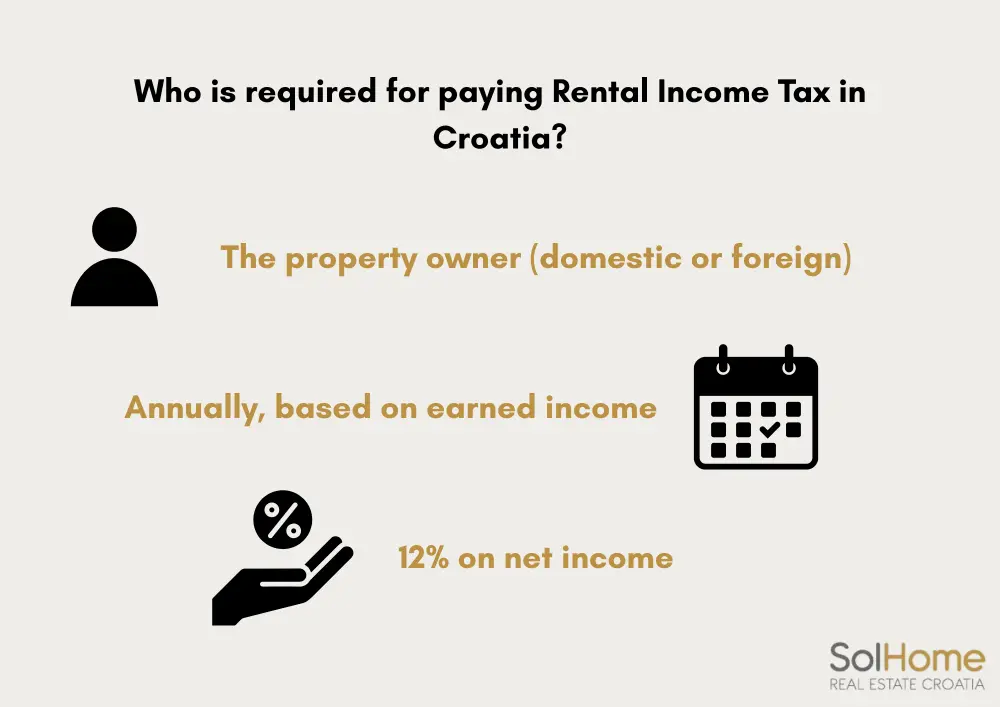

The standard rental income tax in Croatia is 12% on net income (income minus justifiable expenses). When and in which cases flat-rate taxation applies – it is recommended to inform yourself on the official website of the Tax Administration, where the latest data on real estate income taxes are regularly updated. Additionally, consulting with tax experts is highly recommended due to regular changes and updates in tax laws.

VAT on property rental in Croatia is paid if the rental is of a commercial nature (e.g., rental of business premises) and the landlord is a VAT payer. Additionally, if the property is a newly built property (less than 2 years old), a VAT rate of 25% applies. In short, VAT applies if the landlord is a VAT payer and the property is a new property.

The tourist tax is mandatory for tourists staying in Croatia, and the amount depends on the type of accommodation, location, and season. It represents a source of income for tourist boards and is used for the development of tourism offers and the improvement of local infrastructure. As with any tax, there are cases where payment of this fee is exempt—read more on the topic here.

If you own a property in Croatia and do not use it for residential purposes or long-term rental, but leave it empty or use it for short-term rental, you are obliged to pay property ownership tax. What kind of property tax is it, who is obliged to pay it, why, how often, and in what amount – read on below.

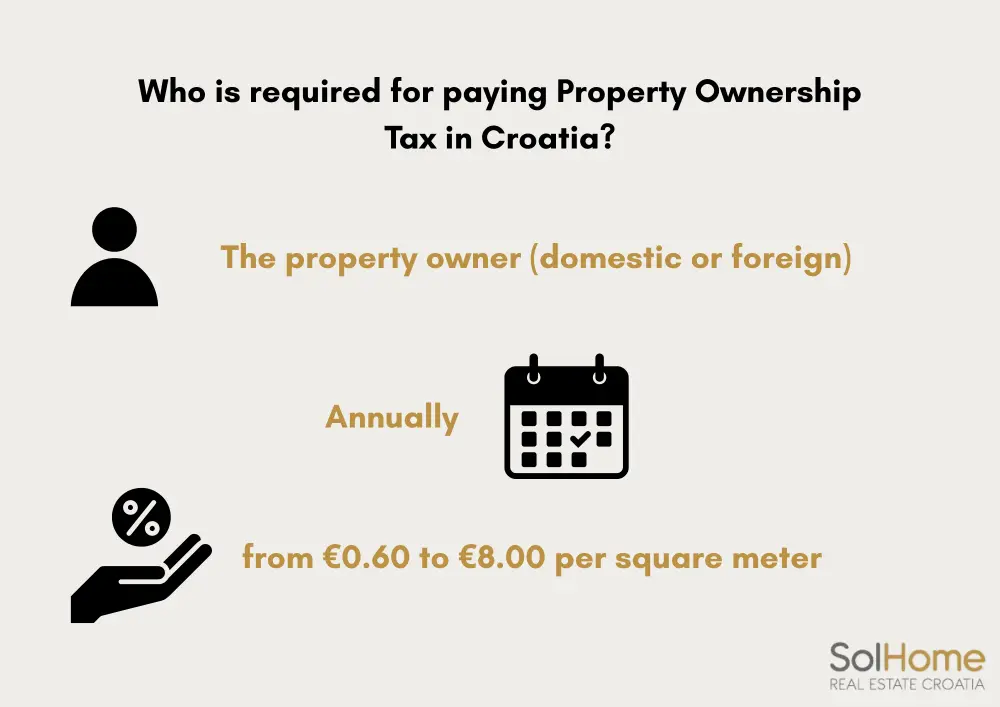

In 2025, Croatia introduced a new property ownership tax, replacing the previous tax on holiday homes. The new tax applies to all residential buildings and individual residential units. Want to know how much it is, who needs to pay it, and who is exempt? Continue reading.

As stated on the official website of the Croatian Tax Administration, the property tax must be paid by: The property owner, whether a legal or natural person (domestic or foreign). Exceptionally, if the owner cannot be determined, the property tax must be paid by the user of the property, as defined by regulations on utility services.

Who is exempt from paying this tax?

The property tax does not apply to properties used for permanent residence or those rented out under a long-term lease agreement (at least 10 months). There are also several specific situations where this tax may not be applicable, as stated on the Croatian Tax Administration website – we recommend reviewing them for accurate and complete information on this tax.

To ensure that your property sale or purchase follows all legal procedures and that you do not miss any tax or cost, contact Solhome. Whether you are buying a home on the Croatian coast or selling your property, we are here to help. Our service is fast, reliable, and we will be happy to guide you through every step. We look forward to working with you.